Do you want to travel more? Save money to move abroad? Pay down your debt? Have a nest egg so you can start your own business?

Finding the extra cash to do so isn’t always easy. In this article, I’ll share 15 simple money-saving tips to help you keep more cash in your pocket.

We utilized all of the tips in this article when we were saving money to go traveling. In the end, we were able to save enough to set off on our year-long backpacking adventure sooner than we thought.

Here are my top picks for ways to save money this year.

First, Create a Spreadsheet

Before you can put any money away, it’s important to figure out your finances and how much money is available for you to save.

Write down your take-home earnings, and from there, subtract all of your necessary expenses — just the payments you need to make in order to get by.

This is a simple visual way to see all of your payments in one place, and realize how much extra money you have to spend on entertainment, miscellaneous, and of course, savings.

Here’s an example:

Total Monthly Income: $_________.

Monthly Payments:

- Rent / Mortgage

- Groceries

- Cell Phone

- Electricity

- Water

- Car Insurance

- Gas

- Loans

- Credit Card Bill

- Cable and Wi-Fi

Total Monthly Payments: $_______.

Monthly Income minus Monthly Payments = $______.

If your balance each month is in the negative, you’ll need to start making some changes, including making more money on the side, picking up an online job, consolidating your payments, and tweaking your lifestyle.

Have a look at budgeting apps such as Mint (free) and Wally (free) to help you realize your money-saving goals.

Here are 15 easy money-saving tips for you to utilize this year!

1. Say “No” To Dining Out

When it comes to money-saving tips for food, this is by far the easiest one. Have you ever added up the amount of money you spend in a day, week, or month on meals out or coffees?

If you have a Starbucks coffee each morning, that’s roughly $4 every morning.

Going out for lunch during the week will cost around $8 each time for a salad or sandwich.

Do co-workers want to grab some drinks with you after work? That’s about $6 each drink and you’ll probably be hungry after work (and after that beer), so add some finger food for about $10. Don’t forget to add tax and tip!

*One major bonus of working remotely is that you won’t have to feel guilty for saying “no” to co-workers when they ask you to go out for lunch or drinks.

Theoretically, depending on how often you grab drinks or have coffee, you could spend around $28 + tax and tip in just one day.

During the weekends, going out for dinner is what many people enjoy doing. Let’s use Earls Restaurants as an example. I’m going to showcase costs based on their menu as the chain has locations in both the USA and Canada.

For dinner, the cheapest appetizer on the menu (apart from bread and fries) is $9.50. The least expensive main dish on the menu is a margarita pizza for $10.50, followed by chicken tacos for $14. Dessert is $5.

On top of that, you’ll want a drink, which is around $5 for a beer. Cocktails are $10+.

A 3-course dinner out at Earls with a beer will cost you $30 minimum (plus tax and tip).

If you spent an evening out during the week, and one on the weekend, you’re going to spend $60+ in one week. In one month, that’s $240 total. That $240 would go much further at the grocery store.

2. Enjoy Dinner Parties

Obviously you’ll still want to have a social life, so I’m not saying give up on seeing your friends and forgo any fun. But, rather than meeting for drinks at a trendy bar, or going out for dinner, why not host a dinner party?

Between all of your friends, you could rotate who hosts each weekend.

Make the dinner party pot-luck style where everyone brings a dish to contribute to the meal. You can find some awesome recipes on Allrecipes.com.

Or, rather than everyone bringing a dish, each week it could be the host’s turn to make the meal.

Opt for an affordable one-pot style dinner (spaghetti bolognese, chicken stew, minestrone soup, beef and bean chili, etc.) or a baked dish such as lasagna, casseroles, grilled chicken with roasted potatoes…get creative!

Buying booze from the shop rather than a bar is much cheaper. Look for sales at your local liquor store and stock up on beer, wine and spirits.

Enjoying dinner and game night with friends, or drinks and appetizers is a great way to catch up and save money while doing so.

3. Save On Accommodation Costs

Accommodation eats up a massive chunk of the budget each month. But, it doesn’t have to. If you’re looking to save money on having a roof over your head, you have a few options.

If you are currently renting, consider downsizing and moving into somewhere smaller and/or more economical.

If you’re in a townhouse, move to a basement suite or a studio apartment. If you’re in a 2-bedroom, switch to a 1-bedroom. Maybe search for a cheaper neighbourhood. There are many ways to downsize your accommodation.

Rather than renting a 1 bedroom home, can you save money by joining up with someone and having a roommate in a 2-bedroom place?

If you’re comfortable living in someone’s home, consider looking for house sitting jobs. This is my best money-saving tip for accommodation.

You can house sit/pet sit all around the world, including your home city (in many cases). If you live in one of the popular housesitting destinations (England, Australia, Canada, USA) there are a lot of house sits available). You could move from place to place every couple of weeks, all within the same city.

By becoming a house sitter, you’ll receive free accommodation and (in our experience) a vehicle for your use. You’ll get to live like a local for free and enjoy the company of a furry friend.

While you’re trying to save money, this is an especially good way to keep cash in the bank. For more about the house sitting company we use and highly recommend, click here.

4. Use Rewards Credit Cards

If you’re going to spend money, you may as well earn some points while you’re at it. Americans have some great credit cards that offer cash-back and rewards when you purchase groceries. But surprisingly, there are actually some pretty good credit cards for us Canadians as well.

The Blue Cash Everyday card from American Express offers 3% cash-back on grocery store purchases up to $6,000 / year.

After that, they offer 1% cash-back on groceries at supermarkets in the USA. There are other bonuses such as 2% cash-back at the gas station, 1% on other purchases and no annual fee. Click here to learn more.

Another great card is the Capital One Savor Cash Rewards Credit Card. You’ll receive unlimited 4% cash-back on dining and entertainment, 2% when shopping at supermarkets, and 1% on other purchases.

You’ll also get a $500 cash bonus after you spend $3,000 in the first 3 months, and there’s no annual fee for the first month. Click here to learn more.

There are many more cards that offer savings on groceries at supermarkets in the United States. Click here to compare.

For Canadians, even though we don’t typically have the best travel credit cards available, there are a few great credit cards for food and grocery purchases.

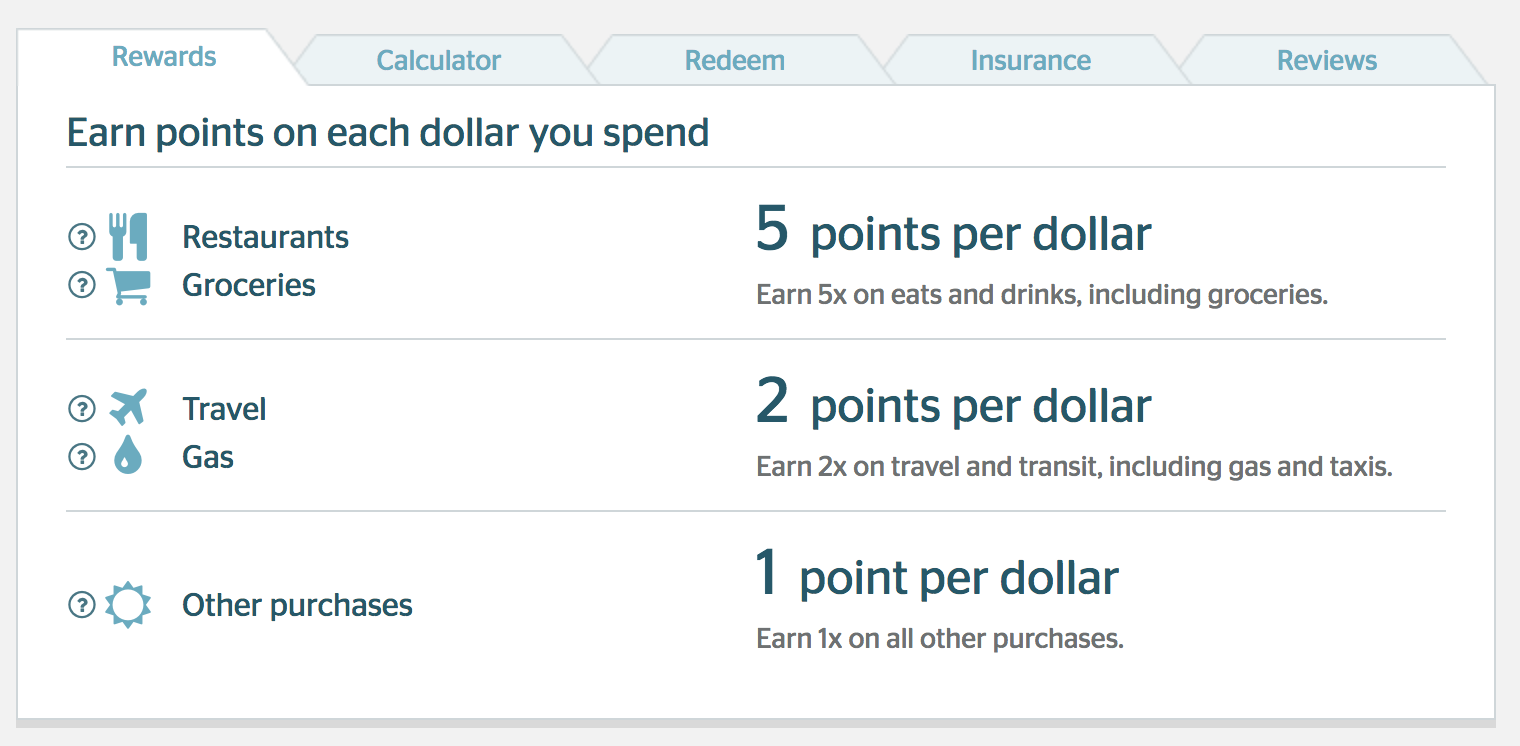

The American Express Cobalt gives you 5 points for every dollar at grocery stores, cafes, bars, food delivery and restaurants. The points you earn can then be redeemed for travel on any airline. When it comes to food, this is a great credit card.

You’ll also get 2 points for every dollar spent on gas, travel, rideshare (Uber), taxis, but just 1 point for all other purchases.

The only downside to the card is that there’s a $10 monthly fee, and American Express isn’t accepted everywhere (but, you can use it at Safeway, Sobey’s, Whole Foods, Co-op, Metro, FoodBasics and more).

If you prefer Visa, a great card is the Scotia Momentum Visa Infinite which offers 4% back on groceries and gas. 2% cashback at drugstores and recurring bill payments and 1% on other items. The $99 annual fee is waived for the first year.

Make this the year that your plastic cards start working for you.

5. Do Some Meal Prep

One of the main reasons that people opt for pricy fast food, or frozen meals is because preparing a healthy meal can take a bit of time. Consider preparing food ahead of time and have it ready to go for the whole week.

Do you drink smoothies in the morning? Pre-cut all of the fruits and vegetables and have them portioned out into containers for each day, then toss them in the freezer.

Each morning, grab out the container, add the liquid of your choice, and blend it up. Cutting up the produce is the time-consuming part. Have it ready to go and you’ll be able to eat healthier and save money by not opting to buy breakfast on the fly.

On Sundays, create meals for the whole week. When we lived in Canada, I used to do this and it saved us buying meals out when there was “nothing to eat” in the fridge.

The best idea is to make a large batch of food – stews, soups, chilis, and sauces freeze well – and make a variety of them so you’re never bored with eating the same food.

Or, portion out meals into containers for the week. Make a large pot of rice, add cooked chicken and a side of vegetables to each container and you’re ready to go. Change them up with various types of vegetables, and maybe mix between couscous, quinoa, pasta and rice.

Things like casseroles and lasagna also freeze well.

Having ready-made meals in the fridge and freezer will stop you from ordering in pizza, or grabbing some fast food on the way home. Making food at home is much more economical and is one of the best money-saving tips.

6. Share Your Clothes

If you have a friend who is the same size as you, this is an excellent way to enjoy two wardrobes for the price of one! It’ll save you going out and shopping for the latest items — and most likely, purchasing things you don’t actually need.

When you “have nothing to wear”, you can call up your friend and do some weekend shopping in their closet. Clothes are expensive and most of us own way too many. Rather than buying something new, consider borrowing.

But, if you must purchase an item and your friend doesn’t have something you can borrow, buy clothing at the second-hand store, opt for outlets, or check out the sales rack.

7. Ditch The Car

Depending on where you live and your lifestyle, you could quite easily sell your car and get around by foot, bike, or public transport.

For couples who own two cars, sell one of them and share the second. Cars are the biggest money guzzlers – petrol, insurance, parking and maintenance, it’s never-ending!

Sell your car and put that money towards your next trip or paying down some debt. Walking and cycling are great ways to get exercise, while public transport options are also very affordable and practical.

When it comes to the best money-saving tips, selling your car and opting for a transit pass is always at the top.

Not only will you be able to put the money from the sale of your vehicle in your bank account, but your monthly transportation budget will be very minimal going forward.

8. Cut Back On Beauty

This one applies to both women and men. While women tend to spend more money, men are starting to put an emphasis on grooming as well.

Go into your bathroom and have a look at all the products you own. Make-up, lotions, perfumes, body wash, hair styling products, beard oils, etc.

Depending on which brands you’ve purchased, if you tallied up the cost, you’ll probably find it’s quite high.

Do you actually need all of those items? Could you get by with a cheaper brand? Could you do without 5 different types of hair products and just use 1?

Cut back on your spending on body and beauty products this year and keep more cash in your pocket.

Although those items are pricey, when it comes to money-saving tips on beauty, my biggest suggestion is to limit your time at the hair salon and spa. Or better yet, don’t go at all.

For women, a simple cut is often around $50+, while colouring or highlighting your hair will easily add another $85+ to the bill. But, you also need to tip on top of that.

Each time you visit the hair salon, you’ll spend around $125 (if you have your hair coloured). Most women do this every 2 months or so, meaning you’ll spend $750 in a year on your hair.

$750 is a round trip flight from New York to Bangkok.

$750 is 15 nights of accommodation (at $50/night).

$750 is a 5-day cruise.

$750 is a lot of groceries!

If you simply must colour your hair, purchase dye from the drugstore. If you need to cut your hair, you can learn to do it yourself, have a friend come by to cut it for you or opt for a cheaper salon to get it cut — less frequently.

Cancel all pedicures, manicures, facials, and spa treatments if you want to save money this year. It’s amazing how much money you can save just by changing your beauty regime.

9. Automate Your Savings

One of the hardest things about saving money is physically transferring the money to a savings account.

A top money-saving tip is to set up automated savings. Simply contact your bank and have them set your account to transfer $X to your savings account each month (or week, or bi-weekly). Or, you can request a certain percentage be transferred into savings.

At the start of this money-saving tips blog post, I mentioned going through your finances to see how much money you have left over after paying the necessities.

Let’s say you have $300 left. You’ll probably want $100 for entertainment in the month (meals out, movies, booze, etc.) and $100 for miscellaneous (toiletries, gifts, medicine, etc.), which leaves you $100 each month that you can transfer to your savings account.

At the end of the year, you’ll have $1,200 in savings! But, if you had to manually transfer that money, odds are you would probably end up spending it instead. Automate your savings, it’s one of my best money-saving tips.

10. Use Cash (for entertainment)

Using your credit card to pay your bills, buy groceries and all other items is what I recommend. But, if you’re budgeting yourself $100 / month for entertainment, then I suggest using cash.

We personally did this when we were trying to come up with $40,000 for a year of travel, and it’s amazing how well it works.

Basically, you have $100 in your wallet (we did $50), and that’s all. No other cash in your wallet. When that $100 is gone, so is the paid entertainment for the month.

You’ll have to get creative and enjoy free entertainment such as watching movies at home, going outdoors, hiking, or having friends over for dinner and games.

Being able to actually see the cash leave your wallet (rather than just swiping your debit card) really makes you decide whether or not you truly need that item you’re about to buy. And if you only have a set amount for the month, you may decide to save it for a special night out.

11. Cancel & Consolidate

Take all of your utility bills and lay them out on the table. Evaluate each of them and decide if you can cancel any of your accounts, or at least, cut back.

Do you have the best cable package? Maybe consider purchasing a Netflix subscription (or something similar) instead for $8 / month.

When it comes to your cell phone bill, do you need that much data, talk-time, texts? For Wi-Fi, can you downgrade your plan to a slower speed (but one that will still stream shows)?

Can you cancel your landline at home?

Is there a better car/life/health insurance plan you can be on?

Could you switch to a gas water heater, rather than electric?

This is one of the top money-saving tips for those of you at home who are trying to save money. Bills seem to stack up and unless you contact your provider to either get a discount or cut back on the plan you’re currently on, you’ll continue to overspend on utilities each month.

12. Cancel Your Gym Membership

This one is huge! So many people make “going to the gym” one of their New Year’s Resolutions, but, most people stop going after a couple of months.

Depending on which gym you go to, you’ll probably spend around $50 / month. And, when you sign up, oftentimes you’re locked into a year’s worth of payments.

Rather than shell out $600+ each year, start working out at home.

There are endless FREE yoga and workout classes on YouTube and Skillshare. All you need is a mat and maybe a few weights.

Rather than joining the gym so you can run on a treadmill, go for an actual run, outside. Go hiking, walking, or cycling —mall of which are free ways to get exercise.

Another option is to join the local recreation center. They’re usually very affordable and you can utilize all of the amenities (swimming pool, squash courts, running tracks, etc.). Plus, many cities have parks with climbing walls, skateboard bowls, ice-skating rinks and running tracks that you can use for free.

Get fit for free this year.

13. Quit Your Habits

I’m not here to give any lectures, but if you are a smoker, vaper, gambler, or heavy drinker, it’s time to quit — or at the very least, cut back…way back. The cost of cigarettes varies depending on which state or province you live in, but on average, they are around $8 a pack.

If you smoke a pack every 2 days, that’s $1,460 that you’re literally burning away each year.

The cost of alcohol is also very high. Either quit drinking, cut back, or purchase a cheaper brand of booze. You’ll be amazed at the amount of money you will save each month. Money that can be put towards a trip, or creating a better lifestyle for yourself.

14. Give DIY Gifts

When you think about money saving tips, cutting back on gift-giving probably isn’t at the top. But, if you consider how many birthday, wedding, baby, anniversary, Christmas, or travel gifts you’ve purchased this year (and did the math), you’ll probably be surprised at how much you spent.

Rather than purchasing presents for friends and family who are celebrating, make them something. A handmade gift is much more thoughtful anyway.

Check out Pinterest for some excellent DIY gift ideas. Or, better yet, give the gift of time. Spend time together doing an activity and create memories that will last much longer than that handbag you bought.

15. Forgo Fees

This is a good one. When you’re out and need to hit up the ATM to get some cash, only go to the ATM at your bank. Each time you utilize another bank’s machine, you’ll pay a fee. Usually, it’s about $5 per withdrawal.

When you use your credit card, make sure you pay off the balance, or at the very least, the minimum amount due, or interest (at a high rate) will start accruing.

If you pay your bills late, there will be a penalty added.

If you have a chequing account with a monthly fee that’s waived if you keep “x” amount of dollars in the account, make sure you don’t go below that amount.

All of these little fees, penalties, and interest costs can really add up over a month. If you do miss a payment, or you accidentally dip below the required amount of cash in your account, contact your bank or service provider and ask them to (please) remove the fee. They usually will.

16. Bonus! Order Groceries Online

Going into the grocery store can be a pain. Not to mention, once you’re there, there are tempting items to buy — especially near the check-out counter.

These days, it’s definitely becoming more mainstream to simply purchase your groceries online and have them delivered to your door.

Not only will you save money due to impulse purchases, and on gas for your car, but ordering online is usually much cheaper than buying in-store — especially for health foods. Compare prices of items like almond butter, coconut oil, hemp hearts, nuts, beans, canned fish, etc. on websites like Amazon before going into the grocery store.

Save even more money by signing up for Thrive Market. This platform is the Whole Foods for people who aren’t rich! Organic, non-GMO, healthy foods are available at a fraction of the cost, delivered right to your house. You can even order frozen meats and seafood, and as a bonus, shipping on items over $49 is free. Click here for details.

Finally, another company which is located in both the United States and Canada is Instacart. Basically, you log-in to an app and order your groceries from the local supermarket. Personal shoppers will then collect the items on your list and you either pick them up at the store or have them delivered to you.

Same day delivery is possible, even within 1 hour. You can purchase 1 month or 1-year memberships and enjoy unlimited deliveries. Exclusive discounts are available for Instacart members. Click here for details.

Your time is valuable. Save time and money and consider ordering online. This is one of the best ways to save money on groceries.

Did These Money-Saving Tips Help?

I hope that the above 16 money-saving ideas gave you some new and useful ways to keep more money in your pocket this year. When you’re saving for a trip, wanting to work for yourself, or simply need to pay down some debt, every penny counts.

My final tip is to make a realistic goal for yourself, one that will allow you to still enjoy your life while putting money away.

If you have a whiteboard, write down how much money you want in your savings account at the end of the year. Focus on that amount, and utilize the above steps to help you realize your money-saving goal.

As always, please feel free to comment down below with your best money-saving tips, or email us with comments and suggestions.

Like This Article? Pin it!

The post 15 Simple Money Saving Tips Anyone Can Use appeared first on Goats On The Road.

from Goats On The Road https://www.goatsontheroad.com/money-saving-tips/

VietNam Travel & Food Magazine Vina.com offers News✅ Travel info✅ Food Recipes✅ Photos✅Restaurant Guide at Vina.com https://vina.com/travel/nightlife/ https://vnfoodandtravelblog.blogspot.com/

0 Nhận xét